Policy Paper 55: Whole Farm Revenue Protection: A Crop Insurance Available in All Wyoming Counties

Introduction

Crop insurance coverage is available for 15 individual crops or crop groups in Wyoming. However, for several crops federally-subsidized insurance coverage is only available in a limited number of counties.

When crop insurance is available in a county for a crop produced under irrigation, insurance coverage is usually available both for crops produced under conventional practices and, for most crops, under certified organic production practices. Crops produced under an irrigation practice for which individual crop insurance coverage is available in one or more counties in Wyoming are: alfalfa seed; several types of barley; corn for grain and for silage; numerous types of dry edible beans; dry peas, smooth green or yellow; forages including alfalfa, alfalfa/ grass, and grass/ alfalfa; forage seed for alfalfa and alfalfa/grass; oats; potatoes; sugar beets; sunflowers for confectionary use and for oil; and spring wheat and winter wheat.

When crop insurance is available for a crop in a county produced under non-irrigated production practices, the insurance coverage is also usually available for crops produced under conventional practices and, for some crops, under certified organic production practices. Crops produced under a non-irrigated practice with coverage in one or more Wyoming counties include smooth green and yellow dry peas; forage production including alfalfa, alfalfa/grass and grass/alfalfa; oats after summer fallow and continuous oats; spring wheat after summer fallow and continuous spring wheat; and winter wheat after summer fallow and continuous winter wheat.

Most of the crop insurance coverage in Wyoming for individual crops, irrespective of production practice, is based on the actual production history (APH) for the crop. That is, the insurance is based on a producer's actual production history over time. A producer selects a coverage level, a percentage of the approved per acre yield for a crop for the purpose of insurance on the area to be insured. That approved yield is calculated using the farm’s actual production history for the crop on the area to be insured. In some cases producers may insure an individual crop using an group risk insurance product where the insurance coverage level is some producerchosen percentage within a specified range of the expected area yield for the crop. The expected area yield on which a group risk insurance product is based is often the county-wide yield for the crop in the county in which the farm is located.

The Pasture, Rangeland, Forage Vegetation Index (PRFVI) pilot insurance policy is available to Wyoming forage producers who want to manage production risks associated with hayland and grazing land. This group risk product is based on a normalized vegetation index that reflects the historical conditions of the area insured. In this case the area is a “grid” within which all or a part of the area to be insured is located. Typically, several grids are located within any given county. PRFVI is used by ranchers throughout Wyoming, especially to address losses of forage production on grazing land.

However, many Wyoming agricultural producers, especially beginning farmers and ranchers and producers of small acreages of multiple high-value crops, have not used any of the various multiple peril crop insurance policies applicable for individual crops. An insurance product that may be of interest to those producers is the Whole-Farm Revenue Protection Policy (WFRP). This pilot policy has been available to producers in all Wyoming counties in recent years.

The two objectives of this policy paper are to provide a description of the Whole-Farm Revenue Protection Policy and to illustrate the application of WFRP to an example Park County irrigated farm producing several crops. The two objectives are accomplished in the following sections of this policy paper.

Whole-Farm Revenue Protection Policy: The Basics

WFRP is a federally-subsidized whole farm revenue protection plan. A WFRP contract covers revenue losses from farm-raised crop commodities, animal commodities and unprocessed (unaltered) animal products such as milk and wool. Crop and livestock enterprises can be covered under the same WFRP policy.

The WFRP policy was available to agricultural producers in all Wyoming counties in 2018 and is expected to be offered in all Wyoming counties in future years. A WFRP plan can be structured to match a farm’s fiscal year revenues or calendar year revenues.

WFRP insurance provides protection against losses of revenue that an agricultural producer expects to earn from crops and/or livestock produced, and/or the producer expects to obtain from agricultural commodities purchased for resale during the prevailing insurance period. A WRFP plan provides protection against loss of a farm’s expected revenue that results from unavoidable natural causes that occur during the insurance period. In addition, declines in local market prices are presumed to be unavoidable unless a manmade cause is identified that results in a measurable change in price.

Section 92 of the current RMA policy handbook, enumerates causes of loss that are not insurable. (Whole-Farm Revenue Protection Pilot Handbook, 2018 and Succeeding Policy Years. United States Department of Agriculture, Federal Crop Insurance Corporation FCIC-18160 (11-2017), p.57.) Most uninsurable causes are associated with producer mismanagement, including failure to follow good farming practices. For producers using organic production practices actions by other producers, such as spray drift damage from a neighboring farm, could result in the inability of the certified organic producer to market impacted crops as organic, but the loss of organic certification would not be indemnified under the producer's WFRP plan.

A WFRP policy provides farm-specific revenue insurance that covers revenue generated by sales of most products produced on a farm operation. Many producers selecting a WRFP plan will use it for standalone coverage. However, a WRFP plan can also be used as umbrella coverage when a farm operator chooses to insure one or more commodities under commodityspecific yield and revenue crop insurance products based on an individual's actual production history, group plans, and livestock insurance plans that address price risk. When used in conjunction with other insurance plans the premiums for a WFRP plan are adjusted.

A WFRP plan covers the revenue from all commodities produced on a farm including animals and animal products, commodities purchased for resale (up to a value of 50 percent of a farm’s total revenues), and certain crop replanting costs. However, some commodity related farm revenues are excluded from WFRP plan coverage. These include revenues derived from timber, forest, forest products and animals for sport, show or pets.

An operation’s whole farm revenue history and WRFP insurance coverage are based on yields of crops grown on the farm, product quality and marketing history. A WFRP plan provides revenue protection based on a producer's own yield, quality, expenses and price histories, the individual farm’s actual revenue history. Thus revenue calculations are based on local market prices that may be different and either higher or lower than national average prices. For example, a certified organic commodity may be sold at a premium relative to the average market price for the commodity.

A WFRP contract may be well suited for producers with a diverse mix of commodities that are sold into farmidentity preserved markets. Individual commodity losses are not considered in isolation under a WFRP plan. The farm’s revenue from all commodities covered under the WFRP plan determine whether a loss has occurred and the amount of any indemnity.

There are some restrictions on the dollar value of the losses that can be covered under each WRFP contract, and the composition of those revenue losses. The maximum allowable loss under a WFRP contract is $8,500,000. The amount of whole farm revenue that can be insured depends on the coverage level selected by the producer. The maximum farm revenue that could be considered at an 85 percent coverage level is $10,000,000 as the maximum loss would be $8,500,000. At the 50 percent coverage level the maximum farm revenue that could be covered would be $17,000,000. A WFRP contract limits the expected revenue from animals and animal products to $1,000,000 and also limits the expected revenue from nursery/greenhouse enterprises to $1,000,000.

Historical Information Required to Obtain a WFRP Contract

Basic historical information must be provided by a farm or ranch manager who files federal income taxes. This information needs to be available when a producer works with their crop insurance agent to obtain WFRP coverage for the farm or ranch operation. The producer on the Park County example farm is assumed to insure the farm operation’s revenues under a WFRP contract for the 2018 calendar year (A farm or ranch operator who files taxes on a fiscal year basis would assemble needed information for the pertinent fiscal years).

For a 2018 WRFP contract, a farm operator who has managed the farm for at least six previous years must provide historical revenue and expense information for five previous calendar years. In the case of the Park County farm those years would be 2012, 2013, 2014, 2015, and 2016. Note that records for the year immediately previous to the insurance year are not required. That year, 2017 for the example farm, is considered to be a lag year. Often farm or ranch managers will not have filed taxes for that lag year by the time they acquire revenue insurance under a WFRP contract for the current year.

Under certain conditions farm or ranch manager may be allowed to provide IRS information on revenues and expenses for fewer than five years of history. These conditions include situations where production was interrupted in one or more years, the farm operator qualifies as a beginning farmer, or when the entity is not required to file income taxes with IRS.

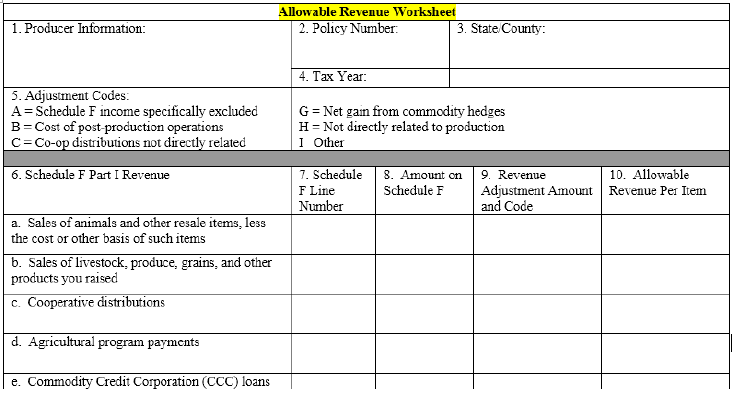

For each of the five years for which basic historical information is required (2012-2016 in the example), the producer's crop insurance agent will provide an Allowable Revenue Worksheet to summarize farm revenues in each year. This form, and other forms and worksheets for the WFRP policy are developed by the approved insurance provider the producer’s insurance agent represents. Those forms must conform to Risk Management Agency specifications.

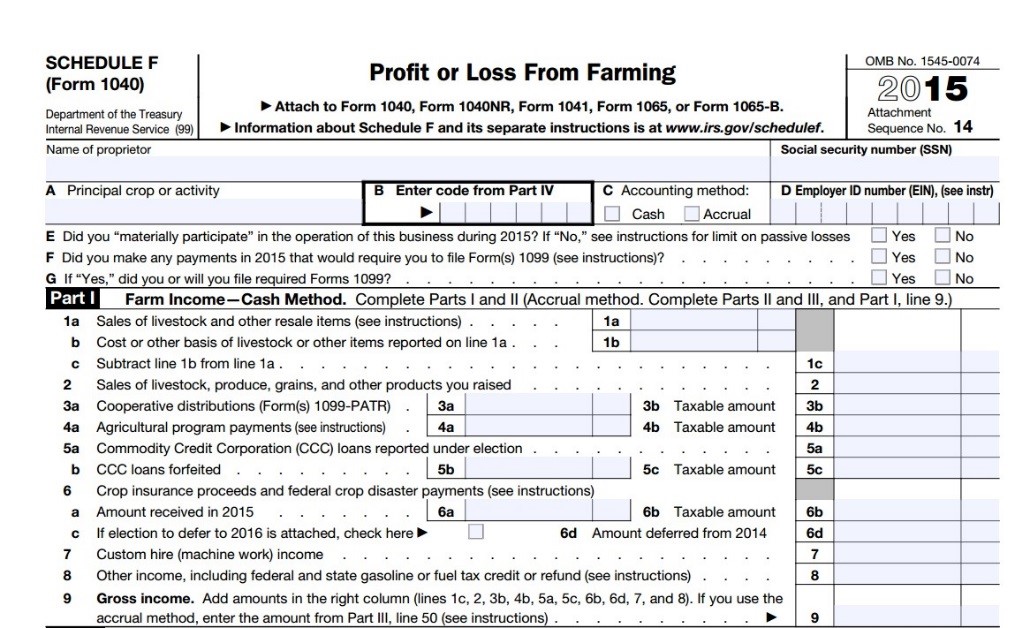

Allowable Revenue is defined as farm revenue from the production of commodities produced on the farm, or purchased for further growth and development on the farm, that the federal Internal Revenue Service (IRS) required to be reported on the farm operation’s tax returns. Allowable Revenue includes revenues from all insurable commodities. IRS Schedule F (or its equivalent) serves as the primary source of the historical information reported on the Allowable Revenue Worksheets for each year in the farm’s financial history.

Part I of IRS Schedule F reports Farm Income. Referencing Part I of IRS Schedule F, farm revenue information can be transferred from this tax form to an Allowable Revenue Worksheet. For instance, Line 1 a, b, and c information from Part I of IRS Schedule F is transferred to the Allowable Revenue Worksheet being used by the producer’s insurance agent. Likewise livestock and farm-raised crop income reported on Line 2 of Part I of IRS Schedule F is also transferred to the Allowable Revenue Worksheet, and the correspondence and transfers continue. Example WFRPAllowable Revenue and Expenses Worksheets very similar to those provided by an approved insurance provider are included in Appendix I of this policy paper.

Most of the farm income that would be reported on lines 4a through 8 in Part I of IRS Schedule F is excluded from Allowable Revenue. A list of excluded revenue items is presented in the Whole-Farm Revenue Protection Pilot Handbook (Whole-Farm Revenue Protection Pilot Handbook, 2018 and Succeeding Policy Years. United States Department of Agriculture, Federal Crop Insurance Corporation FCIC-18160 (11-2017), p.22-23.)

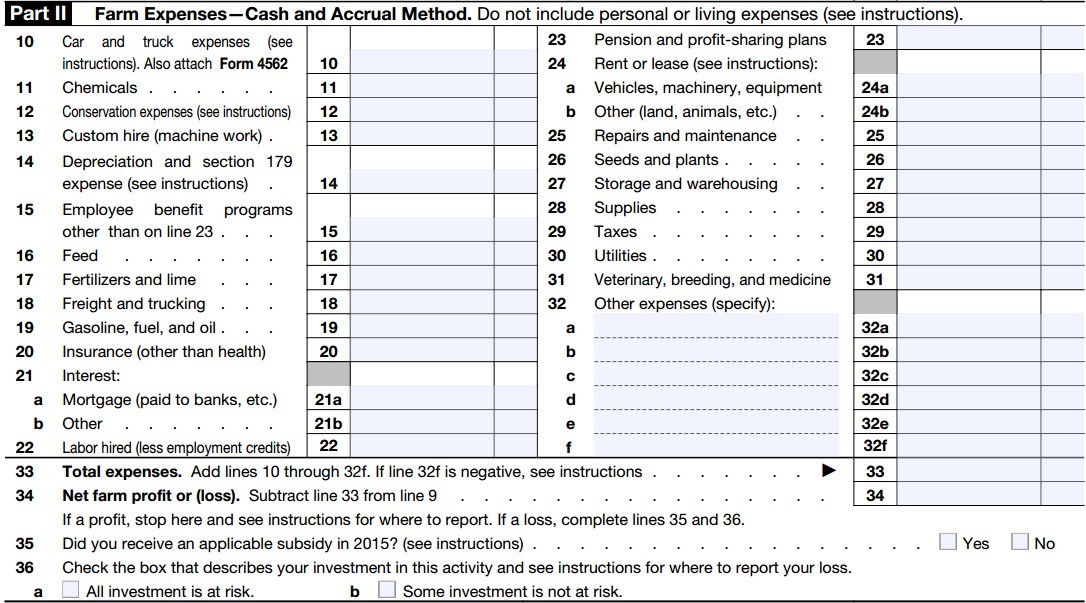

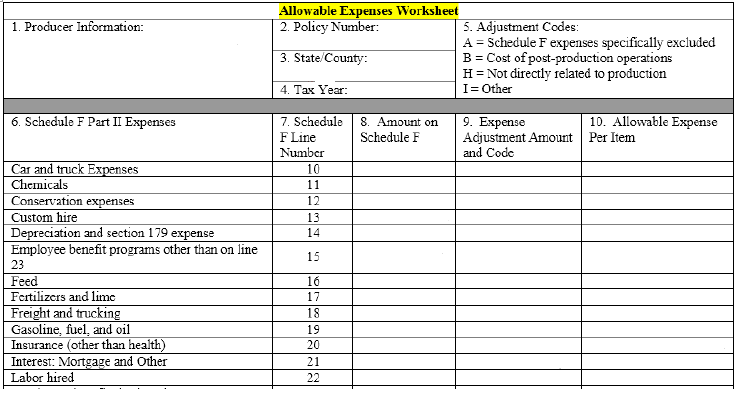

Farm Expenses are reported on Part II of Schedule F. Most of the expenses reported on lines 10 through 32 of Part II Farm Expenses of Schedule F are Allowable Expenses. Expenses that are allowed would include truck expenses, expenditures for chemicals, feed, fertilizer, freight, fuel repairs and maintenance, seed, veterinary and medicine, etc. Excluded expenses include mortgage interest, labor hired, pension and profit-sharing plans, rent and lease payments, taxes, and other expenses not directly related to the production of commodities. Other Expenses, listed on Line 32 of Schedule F, are limited to those directly related to the production of commodities.

Allowable Expenses specifically exclude any expenses associated with post-production operations, or commodities in which the farmer does not have an insurable interest.

Allowable Expenses are transferred from Part II of Schedule F to a WFRPAllowable Revenue and Expenses Worksheet. Included in Appendix I of this policy paper is an Allowable Expenses Worksheet similar to one provided by an approved insurance provider.

Allowable Revenue and Allowable Expenses are recorded for each relevant year in the farm’s financial history (2012-21016 in the example) for the year being insured (2018). Once revenue and expense are entered for each year of the history for the insured year, the yearly totals for revenue and expenses are entered on the Whole-Farm History Report.

Historical Information for the Example Farm

In recent years, some farms in Park County have expanded their crop mixes beyond those traditionally grown in the county. Certain farm managers have initiated the production of seed for crops such as carrots and select grasses including native grasses blue gramma and wildrye and non-native timothy grass seed.

Others have produced specialty crops including spineless safflower and cold-hardy

soybeans. The manager of the example farm has incorporated the production of cool

climate soybeans into a previously traditional crop rotation and has produced sweet

corn for the fresh, direct market in recent years.

The example farm is located in Park County. The farm produces four separate crops

on 240 irrigated acres. The crops are alfalfa (established and growing on 120 acres),

soybeans (planted on 50 acres), corn for grain (planted on 40 acres), and sweet corn

raised for the fresh market (planted on 30 acres). The insurance year is 2018. Allowable Revenues and Allowable Expenses totals for the farm from those crops in each year (2012, 2013, 2014, 2015 and 2016)

are recorded on the Whole-Farm History Report for each year in the farm’s financial history. Total revenue for the five year period

is reported on line 9 as $766,460 and the expense total is $535,930. The simple averages

of the two five year series are calculated and entered on Line 10 as $153,292 and

$107,186.

Line 11 of the Whole-Farm History Report reports an indexed value for revenue and an indexed value for expenses. Indexing is permitted when the last two years of Allowable Revenue exceed the simple average revenue over the farm’s five-year history. The 2015 Allowable Revenue value is $154,600 and the 2016 value is $175,360, so both years exceed the five-year average of $153,292. Therefore, indexing is allowed for the example farm.

|

Whole Farm History Report |

|||

|

1. Producer Information: |

2. Agency Information Agent Code: XX |

||

|

3. Insurance Year |

4. IRS Accounting Method: Cash |

5. State/County: Wyoming/Park |

|

|

|

|||

|

6. Tax Year |

7. Allowable Revenue |

8. Allowable Expenses |

|

|

2012 |

$ 145,000 |

$ 98,500 |

|

|

2013 |

$ 164,500 |

$ 124,660 |

|

|

2014 |

$ 127,000 |

$ 98,500 |

|

|

2015 |

$ 154,600 |

$ 88,900 |

|

|

2016 |

$ 175,360 |

$ 125,370 |

|

|

9. Total |

$ 766,460 |

$ 535,930 |

|

|

10. Simple Average |

$ 153,292 |

$ 107,186 |

|

|

11. Indexed |

$ 198,666 |

$ 118,762 |

|

|

12. Expanded Operation |

$ 164,022 |

$ 114,689 |

|

|

13. Whole-Farm Historic Average |

$ 198,666 |

$ 118,762 |

|

The indexing procedure for Allowable Revenue is as follows: the 2013 value is divide by the 2012 value; the 2014 value is divided

by the 2013 value; the 2015 value is divided by the 2014 value; and the 2016 value

is divided by the 2015 value. These four ratios are then summed and the average of

the four ratio values is determined. This average is raised to the fourth power,

and then multiplied by the average revenue value reported on Line 10 to obtain the

indexed value reported on Line 11.

The four year-to-year revenue column index ratios are 1.134; 0.772; 1.217; and 1.134. However, no index value can be less than 0.800 and is therefore cupped at 0.800. Similarly, no index value can exceed 1.200, and

is therefore capped at 1.200. For the example farm, therefore, the calculated ratios are adjusted to 1.134, 0.800, 1.200, and 1.134. The total of those ratios is 4.228 and the average is 1.067. The value 1.067 to the fourth power is: 1.067 x 1.067 x 1.067 x 1.067 = 1.296. Thus the simple allowable revenue average, $153,292, is multiplied by 1.296 to provide the indexed value for the example farm’s allowable revenue of $198,666 that is reported on Line 11. Using the same procedure for allowable expenses, an indexed value of allowable expenses for the example farm of $118,762 is obtained.

A farm operation may be expanding over time. Such expansion can be taken into account in estimating allowable revenues and allowable expenses.

The Whole-Farm History Report also records revenue and expense values for an Expanded Operation. The allowable revenue for an Expanded Operation will be calculated when a farm manager provides documentation indicating that the operation is physically expanding by adding production capacity to the farm (perhaps by adding cropland or through the addition of a greenhouse), increasing the use of existing production capacity (such as reducing seeder row spacing), or making physical alterations to the existing production capacity (perhaps adding irrigation to the existing cropland). Such forms of production expansion need to be documented, verified and approved for purposes of this insurance product.

Producers should be aware that a change in crop rotation or the planting of a higher value crop without changes to the farming operation's production capacity is not considered to be physical expansion.

Procedures for determining the percentage of expansion depend on several variables including the years in which the expansion occurred. The procedures and example with calculations are presented in the handbook (Whole-Farm Revenue Protection Pilot Handbook, 2018 and Succeeding Policy Years. United States Department of Agriculture, Federal Crop Insurance Corporation FCIC-18160 (11-2017), p.45 - 49).

An expansion factor will be approved by adding the amount of expected revenue due to expansion to the Average Allowable Revenue and then dividing that amount by the Average Allowable Revenue. The maximum allowable value for this ratio is 1.35 (implying a maximum value expansion factor of 35 percent of the five-year Average Allowable Revenue).

On the example farm, an existing irrigation well was deepened and reactivated during the lag year, 2017. The reactivated well provided additional irrigation water to use in conjunction with the water allocated by the irrigation district. Farm revenue increased by $11,000 in the lag year and it is expected that the increased revenue will continue in the future. The expansion factor was calculated as: ($11,000 + $153,292) / $153,292 = 1.07.

The Expanded Operation allowable revenue value is the Simple Average allowable revenue value multiplied by the approved expansion factor. In the example for the Park County farm the allowable revenue is $164,022 = ($153,292 x 1.07). Similarly, the average of the allowable expenses are increased by the approved expansion factor of 1.07.

The producer's whole-farm historic average revenue is the higher of the (1) simple average, (2) indexed average revenue, if applicable, or expanded operation adjusted revenue, if applicable. For the example farm the Whole-Farm Historic Average Revenue is $198,666, the indexed value.

Farm Information in the Current Year

Once the farm's history is appropriately documented, the producer must complete an Intended Farm Operation Report. This report enables the farm manager to provide all the information required for the commodities that will be produced in the insurance year.

The Park County farm manager decides to produce and market the mix of crops he has produced in recent years. However, he plans to expand the acreage planted to his specialty crop, fresh market sweet corn, which he produces and markets directly to consumers and to retail grocers in regional markets in Cody and Billings.

Using yields for the four crops, based on documented recent production experience for these crops including the improved performance in the lag year, and expected prices based on crop insurance price information and local market price expectations, the expected revenue from 2018 production is $163,420, as summarized on the Intended Farm Operation Report. This report and other contemporaneous information documenting yield expectations and commodity prices including the prices for sweet corn sold directly retail customers are forwarded to his crop insurance agent.

Example 1: WFRP Farm Operation Report

|

Intended |

Revised |

|||||||||||||

|

Year of Harvest |

Commodity Name/Code |

Method of Establishment (acres, head, etc.) |

Yield Per Unit of Measure |

Unit of Measure (bu, ton, box, etc.) |

Expected Value |

Expected Revenue |

Intended Quantity (number of acres, head, etc.) |

Cost/Basis and/or Value |

Share |

Total Expected Revenue |

Revised Quantity (number of acres, head, etc.) |

Actual Cost/Basis and/or Value |

Share |

Total Expected Revenue |

|

2018 |

Soy Beans 1008 |

Acres |

49 |

bu |

10.16 |

498 |

50 acres |

0 |

1.00 |

24,900 |

50 acres |

0 |

1.00 |

24,900 |

|

2018 |

Alfalfa |

Acres |

3.6 |

Ton |

123 |

443 |

120 acres |

0 |

1.00 |

53,160 |

120 acres |

0 |

1.00 |

53,160 |

|

2018 |

Sweet Corn |

Acres |

0.5 |

Ton |

4,000 |

2,000 |

30 acres |

0 |

1.00 |

60,000 |

30 acres |

0 |

1.00 |

60,000 |

|

2018 |

Corn, grain |

Acres |

160 |

bu |

3.96 |

634 |

40 acres |

0 |

1.00 |

25,360 |

40 acres |

0 |

1.00 |

25,360 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Expected Revenue @ Sales Closing Date (SCD) |

163,420 |

|

||||||||||||

|

Total Expected Revenue @ Revising Reporting Date( RRD) |

|

|

TOTAL |

163,420 |

||||||||||

|

Total Expected Revenue @ SCD |

163,420 |

|

||||||||||||

|

Whole-Farm Historic Average Revenue |

198,666 |

|||||||||||||

|

Total Expected Revenue |

|

|

|

163,420 |

||||||||||

|

Approved Revenue |

163,420 |

|

163,420 |

|||||||||||

|

Approved Expenses |

126,600 |

|

126,600 |

|||||||||||

Example 2: W-FRP Commodity Count Calculation

|

Commodity Name/Code |

Method of Establishments |

Yield |

Expected Value |

Expected Revenue |

Intended Quantity |

Cost/Basis and/or Value |

Total Expected Revenue |

|

Soybeans 1008 |

Acre |

49 bu |

$10.16/bu |

$498 |

50 acres |

---------- |

$24,900 |

|

Alfalfa |

Acre |

3.6 ton |

$123/bu |

$443 |

120 acres |

---------- |

$53,1630 |

|

Sweet Corn |

Acre |

0.5 ton |

$4,000/ton |

$2,000 |

30 acres |

---------- |

$60,000 |

|

Corn |

Acre |

160 bu |

$3.96/bu |

$634 |

40 acres |

---------- |

$25,360 |

|

TOTAL |

163,420 |

||||||

The crop insurance agent uses information from the Intended Farm Operation Report to carry out a commodity count for WFRP insurance premium and premium subsidy purposes. He uses the RMA WFRP---Commodity Count Calculation tool as an aid in making the count. This tool has different commodity codes for different crops. The tool is used to determine which crops have sufficiently large sales to be included in the commodity count. The codes for the example farm’s four crops are as follows:

- 1008 for irrigated soybeans

- 0850 for irrigated alfalfa hay

- 1001 for irrigated corn (for grain)

- 0044 for sweet corn (for the fresh market)

For WFRP purposes, the commodity count determinant = 1.0/number of commodity codes X 0.333 X the farm’s expected revenue. For the example farm, the commodity count determinant is 1.0/4 X 0.333 X $163,420 = $13,605. The commodity count for WFRP purposes is the number of commodities with expected revenues greater than commodity count determinant, sales in excess of $13,605 for the example farm. Four commodities meet this criterion for the example farm.

WFRP Insurance for 2018

The amount of WFRP insurance that can be obtained is based on theApproved Revenue for the farm for the 2018 crop year. Approved Revenue is the lesser of the Whole Farm HistoricalAverage Revenue ($198,666) or the Total Expected Revenue ($163,420). Approved Revenue is therefore $163,420

A farm’s Approved Expenses are based on the determination of the farm’s Approved Revenue. If the ApprovedRevenue on the Farm Operation Report is equal to the Total Expected Revenue, Approved Expenses are calculated as follows: divide the farm’s Total ExpectedRevenue by the Average Allowable Revenue on the Whole-Farm History Report and multiply this ratio by the Average Allowable Expenses on the Whole-Farm History Report.

For the Park County farm, the Approved Revenue is $163,420, the Total Expected Revenue for the 2018 insurance year. The Average Allowable Revenue is $153,292. The ratio of these two values is: 1.066 = $163,420/$153,292. The Average AllowableExpenses are $118,762. The Approved Expenses are 1.066 x $118,762 = $126,600/

If the Approved Revenue is equal to the Whole-Farm Historical Average Revenue, Approved Expenses are equal to the Whole-Farm Historical Average Expenses.

Once this information is prepared by the farm manager (in cooperation with his insurance agent), the farm manager needs to provide the following to his insurance agent prior to the sales closing date for WFRP:

- Application for WFRP

- IRS Tax Forms 1040 Schedule F

- The Intended-Farm Operation Report for the insurance year

The application must also be accompanied by the following forms and worksheets:

- Allowable Expenses Worksheets

- Allowable Revenue Worksheets

- Whole Farm Operation Report

- Beginning Inventory Report (if applicable)

- Account Receivable and Payable Report (if applicable)

- Market Animal and Nursery Inventory/Accounting Worksheets (if applicable)

The inventory and accounts receivable/payable worksheets must be filled out if the producer carries product or input inventory over the end of the insurance period. These forms are needed to assure that revenue is attributable to production that occurred in the insured year and that expenses are for inputs to production in the insured year.

The crop insurance agent, working with the producer, will determine the insurance premium for 2018 WFRP coverage. However, the farmer can use the RMA online cost calculator to obtain a reasonable estimate of the premium he will pay for WFRP coverage at different coverage levels.

For WFRP, as is generally the case for RMA crop insurance products, the farm-level premium depends on the county where the farm is located. The premium also depends on the commodities being grown, the percentage of revenue from each of the commodities grown, and the commodity count (the more diversified the farm, the lower the premium rate). The premium calculation is influenced by a farm’s location and diversification. The premium payment is calculated as: Premium = Insured Revenue x premium rate, where Insured Revenue = (Approved Revenue x Coverage Level).

In Wyoming and other western states, a farmer or rancher cannot include insurance liability for commodities such as pasture or rangeland covered by vegetation index policies because these commodities are not insured under the WFRP policy (such commodities are excluded from approved farm revenue). Further, an 85 percent coverage level is only available to producers whose operations are determined through the commodity count calculation to have a commodity count of three or more commodities.

The premium subsidy is determined by the commodity count calculation. A commodity count of two or more will result in a whole-farm premium subsidy and a commodity count of one will result in a basic premium subsidy.

The example Park County farmer has a commodity count of four. This producer can select an 85 percent coverage level if desired, and is entitled to the whole farm premium subsidy because of his commodity count.

The Park County farmer first wants to obtain insurance premium estimates for using a WFRP contract as a stand-alone coverage revenue risk management coverage for his farming operation. The RMA Cost Calculator provided the following estimated coverage and premiums for the example farm:

| WFRP Coverage Level(%) | WFRP Revenue Coverage($) | WFRP Total Premium($) | WFRP Premium Subsidy($) | WFRP Percent Subsidy(%) | WFRP Producer Premium($) |

WFRP Admin.Fee($) |

|

85 |

138,907 |

12,779 |

7,156 |

56 |

5,623 |

30 |

|

80 |

130,736 |

10,328 |

7,333 |

71 |

2,995 |

30 |

|

75 |

122,565 |

8,457 |

6,766 |

80 |

1,691 |

30 |

|

70 |

114,394 |

6,864 |

5,491 |

80 |

1,373 |

30 |

|

65 |

106,223 |

5,417 |

4,334 |

80 |

1,083 |

30 |

|

60 |

98,052 |

4,510 |

3,608 |

80 |

902 |

30 |

|

55 |

89,881 |

3,685 |

2,948 |

80 |

737 |

30 |

|

50 |

81,710 |

3,023 |

2,418 |

80 |

605 |

30 |

After reviewing the revenue coverage that could be obtained using a WFRP contract for stand-alone coverage, the Park County producer selects the 75 percent coverage level providing the operation with $122,565 in revenue coverage.

However, the Park County producer also wants to evaluate premium costs using WFRP for partial umbrella coverage. Historically this producer has used a yield protection product to insure the farm's corn for grain production at a 75 percent coverage level. To obtain a 75 percent coverage level crop insurance contract for the farm’s 40 acres of corn, which have an APH of 160 bushels per acre, the producer premium would be $ 1,314. The trigger yield is 120 bushels. The crop insurance liability at this coverage level is $19,008.

If the producers insures the 40 acres of the corn under a crop- specific yield-based crop insurance product, his producer premiums for the umbrella WFRP contract will be reduced at all coverage levels, as shown in the coverage and premium table below.

If the Park County producer purchased an APH yield crop insurance contract for corn crop and also purchases a WFRP contract (both at the 75 percent coverage level), the total producer premium paid for the joint coverage will be the sum of the producer premium for the APH yield contract for the corn crop and the producer premium for the WFRP umbrella contract.

The producer's premium amount would then be: $1,314 + $1,429 = $ 2,743. This exceeds the premium of $ 1,691 the producer would pay if the WFRP contract were used as a stand-alone risk management product. Also, the Park County producer would also incur two $30 administrative fees, not one.

Producers must file a Revised Farm Operation Report to report any changes in the farm operation subsequent to the sales closing date for WFRP. For instance, the farmer might have been prevented from planting a particular crop or had the contract price change on the sweet corn contracted to a fresh market buyer. The example Park County producer would have to file this report by July 15, 2018 because his insurance year is the calendar year. No revisions were required.

| WFRP Coverage Level (%) | WFRP Revenue Coverage($) | WFRP Total Premium($) | WFRP Premium Subsidy($) | WFRP Percent Subsidy(%) | WFRP ProducerPremium($) | WFRP Admin.Fee($) |

|

85 |

138,907 |

11,301 |

6,177 |

56 |

4,854 |

30 |

|

80 |

130,736 |

8,827 |

6,267 |

71 |

2,560 |

30 |

|

75 |

122,565 |

7,145 |

5,716 |

80 |

1,429 |

30 |

|

70 |

114,394 |

5,743 |

4,578 |

80 |

1,145 |

30 |

|

65 |

106,223 |

4,448 |

3,558 |

80 |

890 |

30 |

|

60 |

98,052 |

3,636 |

2,909 |

80 |

727 |

30 |

|

55 |

89,881 |

2,906 |

2,325 |

80 |

581 |

30 |

|

50 |

81,700 |

2,320 |

1,856 |

80 |

464 |

30 |

WFRP Insurance Indemnities

The indemnity process is first considered for WFRP for stand-alone coverage. The Park County producer uses WFRP as stand-alone revenue protection at the 75 percent coverage level for the 2018 calendar year. A mid-summer loss of irrigation water to the farm occurs because of a thunder storm causes a break in the irrigation district's main canal, resulting a three week period when no irrigation water was delivered to the farm. The famer uses the operation’s irrigation well water to complete the first irrigation for the second cutting of the alfalfa hay crop and to irrigate some of the farm’s sweet corn acreage. But the same storm event also brought some localized hail and damaged part of his farm's fields; specifically the fields in which alfalfa and corn for grain were planted.

On July 19, 2018, the Park County producer reports the possible losses of hay and corn for grain production to his insurance agent (and therefore the approved insurance provider) fulfilling the notice of loss requirement that losses must be reported within 72 hours of their initial discovery. This notice of loss requirement is that a producer notify their insurance company that the actual allowable revenue received by the farm during the insurance period could fall below the farm’s insured revenue because of an insurable cause of loss.

The Park County farmer has until 60 days after the original date that the farm’s income

tax forms for the insurance year must be filed with IRS to submit a claim for an indemnity

(the IRS tax forms for the insured year must be submitted as part of the WFRP claims process).

Substantial documentation is required to complete a claim under a WFRP contract. The documentation to be submitted is as follows:

- Claim for Indemnity Report

- Claim Year Tax Form 1040 Schedule F

- Final Farm Operation Report

- Claim Year Allowable Expenses Worksheet

- Claim Year Allowable Revenue Worksheet

- Inventory and Accounts Receivable Worksheet(if applicable

- Market Animal and Nursery inventory Worksheet (if applicable)

- Replant Payment Worksheet (if applicable)

Procedurally, the claim process will initially focus on determining the allowable revenue from the farm tax forms, and adjusting for changes in inventories of insured commodities and changes in accounts receivable accounts. Then allowable expenses will be determined from information available on the farm tax forms for the insurance year. In addition, accrual adjustments will be made for inventoried inputs, etc.

Adjustments may be made to the indemnity provided to the farmer if there is a substantial reduction in actual expenses relative to the expenses expected at the time the WFRP contract was signed, where the lower actual expenses were due to the insurable loss.

Allowable Expenses are determined for the insured year using information transferred to the Allowable Expenses Worksheet from the tax forms. Allowable Expenses are then compared with Approved Expenses, the expenses that were established the time the farmer applied for WFRP coverage.

If the ratio of the two expenses estimates, defined as Allowable Expenses/Approved Expenses, is greater than or equal to 0.70, then there is no expense reduction and no adjustment to Approved Revenue because of any expense reductions that have occurred because of the loss. If the ratio is less than 0.70, a reduction in the Approved Revenue is calculated as follows:

(0.70 – Allowable Expenses/Approved Expenses) x (Approved Revenue) = Dollar reduction in Approved Revenue.

The Adjusted Approved Revenue is calculated as follows: Adjusted Approved Revenue = Approved Revenue - Dollar reduction in Approved Revenue.

Insured Revenue is then calculated as: Adjusted Approved Revenue x Coverage Level.

For the example farm, there a loss of $58,000 in farm revenue for the 2018 production year because of crop damage from hail and the lack of irrigation water until district irrigation water delivery was restored on August 2. Most of that revenue loss was attributable to substantial losses in yield for the corn (for grain) and a diminished amount of production for the second cutting of alfalfa. Sweet corn production was only moderately impacted because irrigation water from the producer's well substituted for the lack of irrigation water from the canal.

In this case, the reduction in expenses is much less than 30 percent of the expenses approved at the time the WFRP contract was signed. So there is no reduction in insured revenue due to the decrease in actual expenses incurred on the farm.

The indemnity to be paid to the example Park County producer would be calculated as follows:

Approved Revenue: $163,420

X

Coverage Level: 0.75

=

Insured Revenue: $122,565

-

Revenue to Count: $105,420= ($163,420 - $58,000)

Indemnity: $17,145 = ($122,565-105,420)

Next, let’s examine the indemnity process for WFRP when the plan is used for umbrella coverage. For the Park County example farm, where corn for grain is insured under an APH yield protection contract, the loss of the corn for grain crop due hail damage and the lack of irrigation water will first be indemnified under the APH yield protection contract. The actual harvested production was 100 bushels of corn per acre. The indemnity is calculated as: [(120 bushels/acre - 100 bushels/acre) x ($3.96/bushel) x (40 acres)] = $3,168. This indemnity amount is then added to Revenue to Countin the calculation of the indemnity to be paid to the farm under the WFRP contract.

The indemnity the example Park County farmer receives under the APH yield protection contract increases the example farm’s Revenue to Count by $3,168.

The indemnity under the WFRP coverage, when used as an umbrella, would be as follows:

Approved Revenue: $163,420

X

Coverage Level: 0.75

=

Insured Revenue: $122,565

-

Revenue to Count: $108,588 = $105,420 + $3,168

Indemnity: $13,977 = ($122,565-$108,588)

The WFRP indemnity is reduced to $13,977. Note that the corn for grain indemnity leads to a dollar-for-dollar reduction in the WFRP indemnity. So the Park County producer would receive the same total indemnity of $17,145.

However the total premium paid by the producer increases when, in conjunction with the APH yield-based crop insurance contract for corn production, the WFRP contract is used as a partial umbrella product. The reason for the premium increase is that the APH corn contract will provide the producer with an indemnity when corn yields fall below an insured trigger yield even when a decrease in farm revenue is not sufficiently large to trigger a WFRP indemnity payment.

Summary

An insurance product that may be of interest to Wyoming farmers and ranchers is the Whole-Farm Revenue Protection Policy (WFRP), a pilot policy that has been available to producers in all Wyoming counties in recent years. This policy issues paper provides an overview and description of the WFRP, which provides protection against unexpected decreases in a farm’s net revenues (income less a set of expenses defined in the policy that are some of the expenses reported on IRS Schedule F by a farm business every year) from multiple crop and livestock operations. Details of the six years of IRS Schedule F records and other information needed to obtain coverage have been described. Explanations have been given of how coverage (liability) is determined and producer paid premiums are calculated. In addition, examples have been provided of how a farm can use a WFRP policy as a stand-alone policy providing revenue protection, or as a “wrap around” policy in combination with federal crop insurance policies that cover losses for a specific crop. Many Wyoming agricultural producers, especially beginning farmers and ranchers and producers of small acreages of multiple high-value crops, have not used any of the various multiple peril crop insurance policies applicable for individual crops. The WFRP product may be of particular interest to those producers.

Appendix

Copyright 2018 All rights reserved.

The U.S. Department of Agriculture (USDA), Montana State University and the Montana

State University Extension prohibit discrimination in all of their programs and activities

on the basis of race, color, national origin, gender, religion, age, disability, political

beliefs, sexual orientation, and marital and family status. Issued in furtherance

of cooperative extension work in agriculture and home economics, acts of May 8 and

June 30, 1914, in cooperation with the U.S. Department of Agriculture, Cody Stone,

Interim Director of Extension, Montana State University, Bozeman, MT 59717.